Financing For Real Estate Investors

Submit a Prescreen To Shop For Loans

Submit a Prescreen To

Shop For Loans

With Sherman Bridge, you can compare programs and terms from numerous lenders in your market.

Submit a Prescreen To Shop For Loans

Submit a Prescreen To

Shop For Loans

With Sherman Bridge, you can compare programs and terms from numerous lenders in your market.

Sherman Bridge is a lending marketplace with proven and vetted lenders who offer competitive loan options for your next deal.

An account executive matches your application with lenders who offer the type of loan you need and takes you through to closing.

The transaction process is streamlined because lenders know how to work with Sherman Bridge and there are no outside delays.

Skip researching and applying with various lenders. We provide all options, whether it’s a deal you have today, or you’re planning ahead.

Any time you need a loan you can compare terms, monthly payments, costs, and loan types.

Fill out a single application and access multiple lenders in your area.

Deal with experienced lenders who offer loan products real estate investors need.

Submit a quick prescreen.

Receive prompt preapproval from lenders that match your loan needs.

Choose a loan product and close your transaction.

We connect you with fast, reliable funding, whether you’re looking to flip a property, buy and hold, or offer financing as a third-party broker.

Get a hard money loan to fund the purchase and rehab of your next flip. We also offer low-interest, purchase-only loans.

Expand your rental portfolio with our 3-year purchase loan. We also offer rate and term refinance and cash-out loans.

Earn competitive origination fees while leveraging the experience and resources of a leading hard money lender.

Get a private money loan to fund the purchase and rehab of your next flip. We also source low-interest, purchase-only loans.

Expand your rental portfolio with a 3-year purchase loan. Find and compare rate and term refinance and cash-out loans.

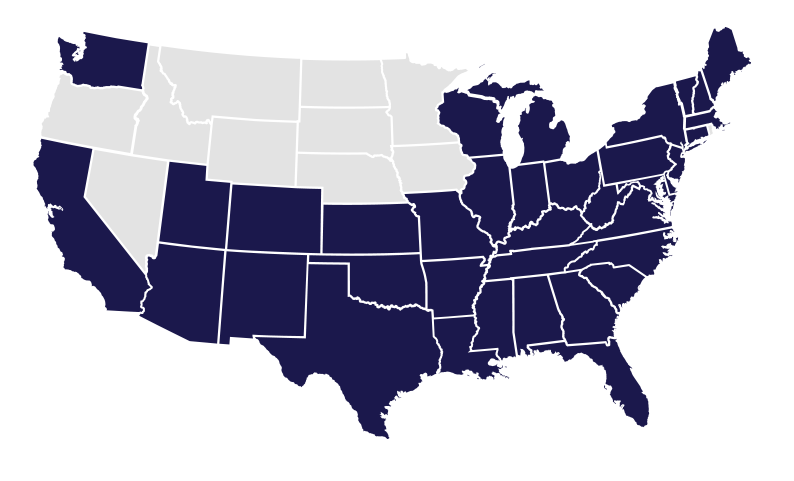

We provide easy access to fix-and-flip and rental loans for investment properties located in the following states — and we’re adding new markets all the time.

Alabama • Arizona • Arkansas • California • Colorado • Connecticut • Delaware • Florida • Georgia • Hawaii • Illinois • Indiana • Kansas • Kentucky • Louisiana • Maine • Maryland • Massachusetts • Michigan • Mississippi • Missouri • New Hampshire • New Jersey • New Mexico • New York • North Carolina • Ohio • Oklahoma • Pennsylvania • South Carolina • Tennessee • Texas • Utah • Vermont • Virginia • Washington • West Virginia • Wisconsin

When you’ve found a good deal, you need to move fast. And you need a lender you can count on. We pride ourselves on our proven and vetted lenders who consistently deliver on time and under pressure because that’s when it matters most.

Your loan officer will work with you to understand your investment strategy, get you pre-approved, and provide a proof of funds letter should you need one.

Once you have a deal, give your loan officer the documentation required to complete your loan and they’ll guide you through the underwriting and closing process.

Depending on your exit strategy, either rehab your investment property to resell within 12 months or buy and hold with a longer-term loan designed for landlords.

Submit a quick prescreen.

Receive prompt preapproval from lenders that match your loan needs.

Choose a lender and close your transaction.

Thank you for reaching out!

One of our loan consultants will be in touch shortly.

In the meantime, see if you’re on top of all the Terms Every Real Estate Investor Should Know or check out our Rehab Checklist & Calculator